1031 Tax Deferred Exchanges Today

By Sharon Thompson, KW Commercial, Indianapolis

The Tax Cuts and Jobs Acts of 2017 (TCJA) made sweeping revisions to the federal income tax laws changing IRC 1031 Tax Deferred Exchanges as well as many other areas of real estate. After much uncertainty and discussion on the fate of 1031 exchanges last year, the IRC Section 1031 Tax Deferred Exchange still continues as a viable tool available to real estate investors since inception in 1921. These end of year tax changes went into effect shortly after passage with limited ability to prepare for impact. With these new rules effective January 1, 2018, sellers and agents should carefully evaluate how new rules apply to today’s real estate transactions.

- Investment property owners will still be able to use 1031 tax deferred exchanges.

Under the US Internal Revenue Code Section 1031 investors are allowed to sell one or more appreciated real estate assets and then defer the payment of capital gains tax by acquiring one or more like-kind replacement properties. These exchanges follow complex rules including a 45 day identification of a replacement property, a 180 day period for completing the closed exchange plus funds must be held in the interim by a third party known as a qualified intermediary.  The Tax Cuts and Jobs Act repealed exchanges on personal property.

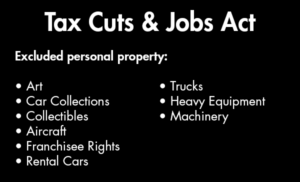

The Tax Cuts and Jobs Act repealed exchanges on personal property.

This tax repeal covers a wide range of formerly allowed tax exchange deferrals. Historically, like-kind properties included both real estate and broader categories including equipment and personal property.The excluded list now includes: Art, car collections, collectibles, aircraft, franchisee rights, rental cars, trucks, heavy equipment and machinery. In Indiana, this impact may be more immediately felt in the sale of farms with equipment such as tractors as well as in small businesses with heavy machinery. With the quick implementation, there may be a need to review long term tax and estate planning as well. To ease the pain, there are short term accommodations for full expensing under strict guidelines as the new law phases in fully by 2022.- Delaware Statutory Trusts (DSTs) still remain an option for Qualified Investors with 1031 Tax Deferred Exchanges.

A DST allows the acquisition of a fractional or percentage interest in high quality, investment grade assets generally available only to large institutions. DSTs are sold as a financial securities product and are only available to Accredited Investors with net worth over 1 million or incomes over $300K Joint Income / $200K Single Income for each of the two preceding calendar years. For qualifying parties, DSTs can provide a strategy to deter capital tax gains, for depreciation recapture and provide a step up basis for wealth transfer. These attributes are worth reviewing with financial professionals. - Additionally other items in this code will impact commercial real estate transactions.

For example, developers will find that Section 1061 extends the holding period requirement from one to three years for long-term capital gains treatment. Home equity loans are no longer deductible while deductions for second mortgages for vacation and resort investments remain. Pass through deductions have a new complex formula for Qualified Business Income only an accountant may fully understand.

In conclusion, with the passage of the first tax law revision since 1986 many real estate transactions have changed. With 2017 taxes in hand, consult with up to date accounting, tax and real estate professionals on your specific situation since it may not be business as usual. Many of these new ambiguous provisions will need to be clarified further over time. When real estate sales and tax deferred exchanges are involved, plan carefully for any exit strategy as well as for the next acquisition. There are a lot in these changes to keep your accountant, financial planner, tax advisor plus your real estate agent busy as well as many property owners happy for the next few years.

Sharon Thompson, EdM, MA is the Executive Director of KW Commercial Indiana in the Keller Williams Indianapolis Metro Northeast office. She is also a registered representative with RCX Capital Group, a registered FINRA broker-dealer focuses on 1031 Exchanges and Delaware Statutory Trusts.