Indiana Farmland Values and Cash Rents Continue to Adjust: A Summary of the 2017 Indiana Farmland Value Survey

by Craig L Dobbins, Professor and Extension Economist, Purdue University

Each June, a survey of people knowledgeable of the changes taking place in Indiana’s farmland market is conducted by the Purdue University Department of Agricultural Economics. The purpose of the survey is to gather information about current farmland values and cash rents, expected changes in these values, and the factors influencing the market. Following a statewide decline in value of 8.2% to 8.7% in 2016, the 2017 survey found a change in values of -1.6% to 0.2%. Top quality land was valued at $8,529, average quality land was valued at $6,928, and poor quality land was valued at $5,280.

In Indiana, 2017 was a tale of two six-month periods. From June 2016 to December 2016, statewide farmland values increased from 1.9% to 2.9%. The much better than average yields of corn and soybeans received in the fall by many producers likely contributed to a brighter outlook. However, as the low prices resulting from an abundant supply resulted in continued low prices, the period of December 2016 to June 2017 saw the farmland land market lose strength and decline by 2.6% to 3.2%. The left statewide farmland values stable from June 16 to June 17.

When asked to forecast what was likely to happen to farmland values in the June 2017 to December 2017 period, the respondents were pessimistic. On average, a statewide decline 2.2% to 3.0 in farmland values is expected.

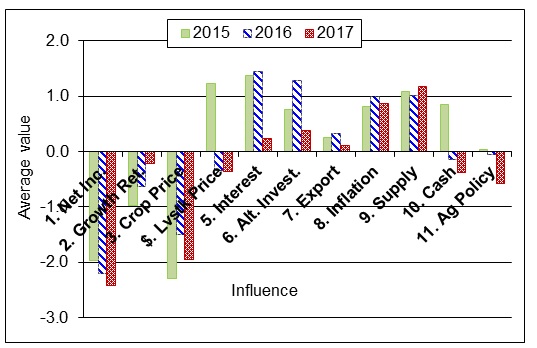

Respondents evaluated the importance of eleven market forces having the potential to influence the farmland market. These items included: 1) current net farm income, 2) expected growth in returns to land, 3) crop price level and outlook, 4) livestock price level and outlook, 5) current and expected interest rates, 6) returns on alternative investments, 7) outlook for U.S. agricultural export sales, 8) U.S. inflation rate, 9) current supply of land for sale, 10) cash liquidity of buyers, and 11) current U.S. agricultural policy.

Respondents evaluated the importance of eleven market forces having the potential to influence the farmland market. These items included: 1) current net farm income, 2) expected growth in returns to land, 3) crop price level and outlook, 4) livestock price level and outlook, 5) current and expected interest rates, 6) returns on alternative investments, 7) outlook for U.S. agricultural export sales, 8) U.S. inflation rate, 9) current supply of land for sale, 10) cash liquidity of buyers, and 11) current U.S. agricultural policy.

Respondents used a scale from -5 to +5 to indicate the effect of each item on farmland values. A negative influence is given a value from -1 to -5, with a -5 representing the strongest negative influence. A positive influence was indicated by assigning a value between 1 and 5 to the item, with 5 representing the strongest. An average for each item was calculated. In order to provide a perspective on changes in these influences across time, Figure 1 presents data from 2015, 2016, and 2017. The horizontal axis indicates the item from the list above.

Given the low grain prices and net farm income, it is not surprising respondents placed a negative influence on net farm income, expected growth in returns, crop prices, and livestock prices. Respondents have become more negative about net income over the three years.

Both the cash liquidity of buyers and the role of agricultural policy have become more negative during this three-year period. In 2012 and 2013, the cash position of buyers was strongly positive and was at its peak as a positive influence. The liquidity of buyers has eroded since 2013. Since we began asking about market influences in 2001, the influence of agricultural policy was negative for the first time in 2016. The negative influence increased in 2017.

The positive influence of interest rates, alternative investments, and exports declined in 2017. Increasing long-term interest rates, expected for several years, now seem to be occurring as the Federal Reserve makes changes to their low interest rate policy. The supply of farmland on the market and expectations about inflation are the strongest positive influences on the 2017 farmland market. Of these 11 influencers of land values, respondents lowered their scores for eight of them this year. One stayed constant, and only two rose.

Statewide, the change in cash rents varied from a decline of 1.6% to an increase of 3.8%. As with farmland values these changes were much smaller than the 9.8% to 10.3% decline reported in 2016. The statewide cash rent for top quality farmland was $253 per acre, average quality land was $205 per acre, and poor quality land was $163 per acre.

When considering the change in cash rent for 2018, seven percent of the respondents indicated that they thought values would increase. The average increase for this group of respondents was 8.2%. Thirty-three percent of the respondents expect no change in cash rents for 2018. Fifty-nine percent of the respondents expected cash rents to decline. The average decline for this group was 9.3%. When combining all responses, the average cash rent decline for 2018 is 4.9%.

Margins in Midwest crop production remain tight. In the short term, a boost in commodity prices does not seem likely. Producers continue to focus on lowering per unit production costs. This creates pressure to hold the line or reduce cash rent. In addition, respondents perceive the cash position of farmland buyers has sharply declined. As a result of these and other market factors, the downward adjustment in the value of farmland and cash rent is expect to continue over the next year. For 2018, a decline 3% to 6% in farmland values and 3% to 5% in cash rent is expected.

Additional information about the 2017 survey is available at https://ag.purdue.edu/agecon/Documents/PAER%20August%202017.pdf. Information about previous surveys is available on the Center for Commercial Agriculture web site, https://ag.purdue.edu/commercialag/Pages/default.aspx. Select Resources > Articles, Spreadsheets and Decision Tools > Land Prices and Cash Rents > Purdue Agricultural Economics Report Land Values Archive.